Life Insurance in and around Reseda

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

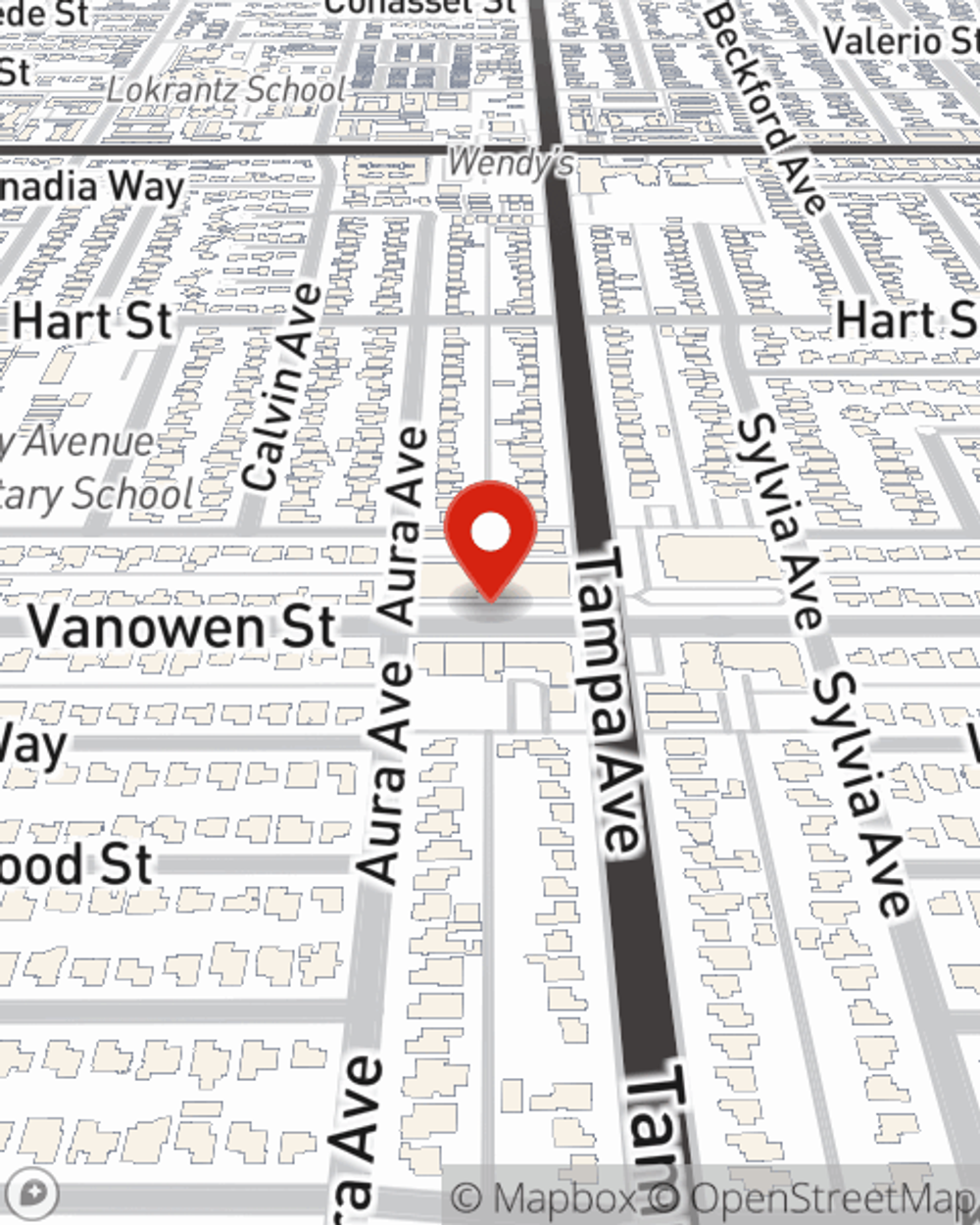

You might think you don’t need to worry about life insurance while you are young. Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Reseda, CA, friends and neighbors both young and old already have State Farm life insurance!

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Life Insurance You Can Trust

Coverage from State Farm helps you rest easy knowing those you love will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with raising children, life insurance is a critical need for young families. Even if you don't work outside the home, the costs of filling the void of domestic responsibilities or housekeeping can be sizeable. For those who aren't parents, you may have aging parents who rely on your income or want the peace of knowing your funeral is covered.

As a leading provider of life insurance in Reseda, CA, State Farm is committed to be there for you and your loved ones. Call State Farm agent Adam Frank today for a free quote on a life insurance policy.

Have More Questions About Life Insurance?

Call Adam at (818) 264-4499 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.